All Categories

Featured

2 individuals purchase joint annuities, which provide a guaranteed income stream for the rest of their lives. When an annuitant passes away, the interest earned on the annuity is managed in a different way depending on the type of annuity. A kind of annuity that quits all repayments upon the annuitant's fatality is a life-only annuity.

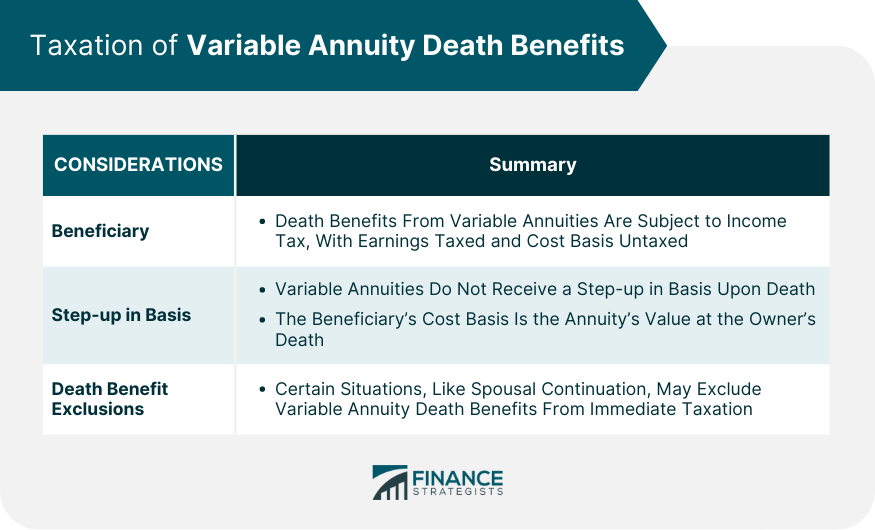

The original principal(the amount originally transferred by the moms and dads )has actually already been taxed, so it's exempt to tax obligations once more upon inheritance. However, the earnings section of the annuity the interest or investment gains accrued over time goes through revenue tax. Normally, non-qualified annuities do.

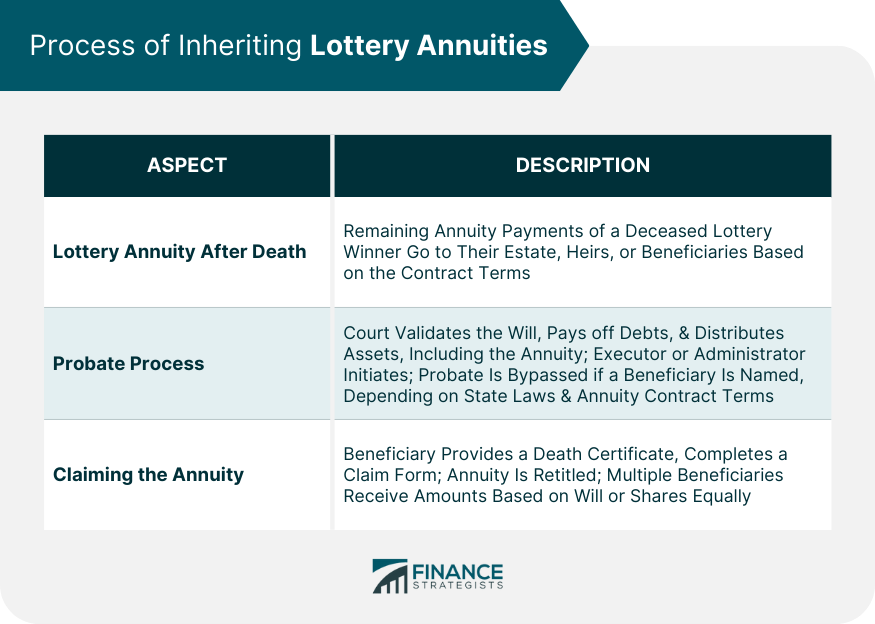

have actually passed away, the annuity's benefits generally revert to the annuity proprietor's estate. An annuity owner is not legally required to educate present recipients regarding changes to beneficiary designations. The choice to alter recipients is normally at the annuity owner's discernment and can be made without informing the existing beneficiaries. Since an estate practically does not exist until a person has actually died, this recipient designation would only enter impact upon the death of the named individual. Normally, when an annuity's proprietor passes away, the marked recipient at the time of death is entitled to the advantages. The spouse can not alter the recipient after the proprietor's death, even if the beneficiary is a minor. There might be specific stipulations for managing the funds for a small recipient. This commonly includes designating a guardian or trustee to handle the funds until the kid maturates. Usually, no, as the beneficiaries are exempt for your financial debts. It is best to get in touch with a tax professional for a particular solution relevant to your situation. You will certainly remain to obtain settlements according to the contract schedule, yet trying to get a round figure or finance is likely not an alternative. Yes, in nearly all cases, annuities can be acquired. The exception is if an annuity is structured with a life-only payment option via annuitization. This kind of payment discontinues upon the death of the annuitant and does not give any recurring value to heirs. Yes, life insurance policy annuities are normally taxable

When taken out, the annuity's incomes are tired as regular income. The principal amount (the preliminary financial investment)is not taxed. If a beneficiary is not called for annuity advantages, the annuity proceeds usually go to the annuitant's estate. The distribution will certainly follow the probate procedure, which can delay payments and may have tax obligation implications. Yes, you can name a depend on as the recipient of an annuity.

Inherited Lifetime Annuities taxation rules

Whatever section of the annuity's principal was not currently taxed and any incomes the annuity built up are taxed as income for the beneficiary. If you inherit a non-qualified annuity, you will just owe tax obligations on the earnings of the annuity, not the principal used to acquire it. Due to the fact that you're receiving the entire annuity at as soon as, you need to pay tax obligations on the entire annuity in that tax year.

Latest Posts

Exploring the Basics of Retirement Options Key Insights on Tax Benefits Of Fixed Vs Variable Annuities Defining Fixed Vs Variable Annuity Pros And Cons Advantages and Disadvantages of Fixed Vs Variabl

Understanding Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Benefits of Indexed Annuity Vs Fixed

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Pros and Cons of Fixed Indexed Annuity Vs Market-variable Annuity Why Ch

More

Latest Posts